Real estate investment can be a lucrative venture, but it requires a keen understanding of market trends. Whether you’re a novice investor or a seasoned veteran, recognizing and interpreting these trends is crucial for making informed decisions. This article will guide you through the key aspects of real estate market trends and how to leverage them for successful investments.

What Are Real Estate Market Trends?

Real estate market trends refer to the patterns and movements in the real estate market over time. These trends can influence property values, demand, and overall market health. Key indicators include:

- Price Trends: Fluctuations in property prices over time.

- Sales Volume: The number of properties sold within a specific timeframe.

- Days on Market: The average time it takes for a property to sell.

- Inventory Levels: The number of available properties for sale.

- Economic Indicators: Factors such as employment rates, interest rates, and GDP growth that can impact real estate.

Understanding these indicators can help investors make strategic moves in the market.

Why Understanding Trends is Important

Understanding market trends helps investors:

- Identify Opportunities: Recognizing upward or downward trends can help you identify the right time to buy or sell. For instance, a rising trend in property values may indicate a good time to invest.

- Assess Risks: Knowing the market can help you evaluate potential risks associated with your investment. A declining market may signal that holding onto a property could result in losses.

- Make Strategic Decisions: Informed decisions lead to better investment strategies, whether you’re flipping houses or acquiring rental properties. Understanding trends allows you to craft a tailored investment strategy that aligns with market dynamics.

Key Factors Influencing Real Estate Trends

Several factors can impact real estate trends:

1. Economic Conditions

The overall economy plays a significant role in real estate. A strong economy typically leads to higher employment rates, increasing demand for housing. Conversely, during economic downturns, demand may decrease, leading to lower prices. Understanding economic cycles can provide insights into when to enter or exit the market.

2. Interest Rates

Interest rates directly affect mortgage rates. Lower interest rates make borrowing cheaper, encouraging more buyers to enter the market. Higher rates can dampen demand as borrowing becomes more expensive. Monitoring interest rate trends can help you time your investments effectively.

3. Demographics

Shifts in demographics, such as population growth or changes in household composition, can influence housing demand. For example, millennials entering the housing market can drive demand for starter homes, while aging baby boomers may seek downsized living options. Understanding demographic trends can help you target your investments more effectively.

4. Government Policies

Government regulations, tax incentives, and zoning laws can affect market conditions. Policies that promote affordable housing can increase demand in certain areas. Additionally, understanding local government initiatives can provide insights into future developments that may impact property values.

5. Technological Advancements

Technology is increasingly influencing the real estate market. From online listings to virtual tours, technology has changed how buyers and sellers interact. Moreover, advancements in data analytics can help investors make more informed decisions based on market trends.

How to Analyze Market Trends

To make informed decisions, consider the following steps:

1. Research Local Markets

Focus on local market conditions rather than national trends. Real estate is highly localized, and trends can vary significantly from one area to another. Delve into neighborhood-specific data to understand the nuances of each market.

2. Utilize Data Sources

Leverage reliable data sources such as:

- Multiple Listing Service (MLS): Provides data on property listings and sales.

- Real Estate Websites: Sites like Zillow and Realtor.com offer insights into property values and trends.

- Government Reports: Look for reports from agencies like the U.S. Census Bureau for demographic and economic data.

- Local Market Reports: Many real estate firms publish quarterly market reports that analyze trends in specific regions.

3. Monitor Market Indicators

Keep an eye on key indicators such as:

- Price Changes: Track how property prices are moving in your target area. Consistent price increases can indicate a strong market.

- Inventory Levels: A decrease in inventory may signal a seller’s market, while an increase can indicate a buyer’s market. Understanding inventory dynamics can help you gauge competition.

- Days on Market: Shorter times typically indicate strong demand for properties. Analyzing this metric can help you decide on pricing strategies.

4. Network with Professionals

Engage with local real estate agents, brokers, and industry experts. They can provide valuable insights and help you stay updated on market conditions. Networking can also lead to potential investment opportunities before they hit the broader market.

5. Analyze Historical Trends

Look at historical data to identify patterns over time. Understanding how the market has responded to past economic events can give you predictive insights for future trends. For instance, analyzing how the market reacted to previous interest rate hikes can help you anticipate future movements.

6. Leverage Technology and Tools

Utilize technology tools like real estate analytics software, market dashboards, and mobile apps that provide real-time data. These tools can simplify the process of monitoring trends and help you make quicker, more informed decisions.

Conclusion

Understanding real estate market trends is essential for making informed investment decisions. By analyzing economic conditions, demographic shifts, and local market indicators, investors can better position themselves to capitalize on opportunities and mitigate risks. As with any investment, staying informed and adaptable is key to long-term success in the dynamic world of real estate.

Investing in real estate is not just about buying properties; it’s about understanding the market landscape. By equipping yourself with knowledge of market trends and leveraging data effectively, you can enhance your investment strategy and secure a profitable future in real estate.

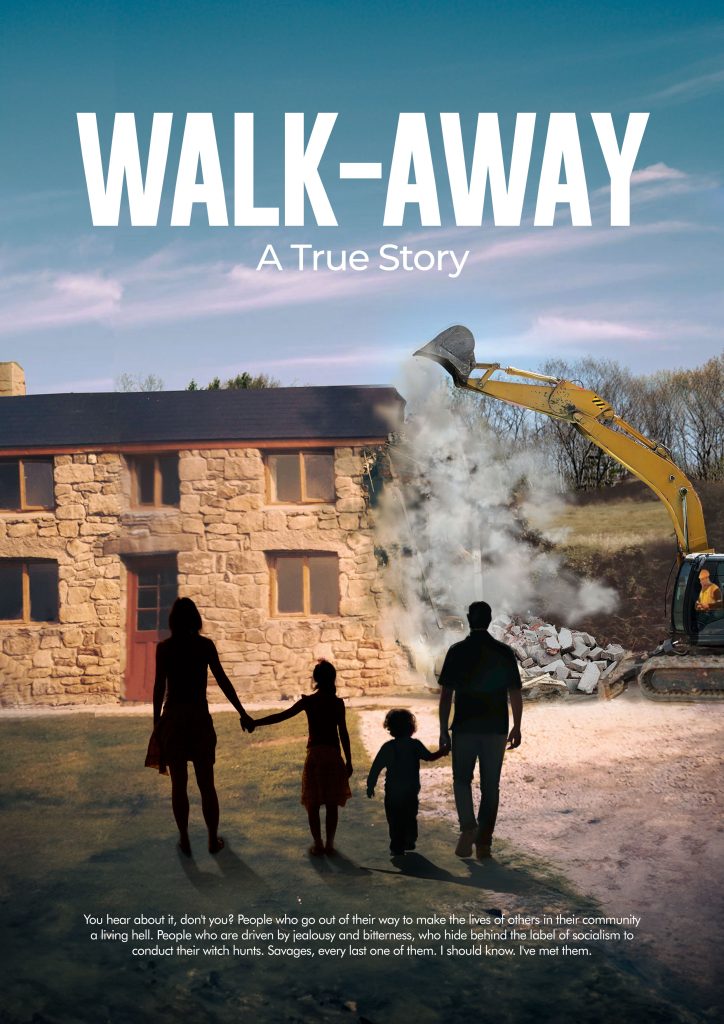

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.