Buying your first home is one of the most significant milestones in life. It can be an exciting adventure, but it also comes with its challenges. To help you navigate the complex world of real estate, here are ten essential tips for first-time homebuyers:

1. Determine Your Budget

Before you dive into the homebuying process, it’s crucial to determine your budget. Start by evaluating your financial situation, including your income, savings, and debt. Consider not just the purchase price of the home, but also ongoing costs such as property taxes, homeowners insurance, maintenance, and utilities.

Using a mortgage calculator can help you estimate your monthly payments based on different price points and interest rates. This will give you a clearer picture of what you can afford without stretching your finances too thin.

2. Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is a vital step in the homebuying process. Pre-approval involves a lender reviewing your financial situation and determining how much they are willing to lend you. This not only helps you understand your budget but also shows sellers that you are a serious buyer.

When seeking a mortgage, shop around to compare rates and terms from different lenders. Look for a lender who offers favorable conditions and is known for good customer service. A pre-approval letter can give you a competitive edge in a hot market.

3. Research Neighborhoods

Location is one of the most critical factors in real estate. Research different neighborhoods to find the one that suits your lifestyle and needs. Consider aspects such as proximity to work, schools, public transportation, and local amenities like parks, grocery stores, and restaurants.

Take the time to visit neighborhoods at various times—during the day, evening, and weekends—to get a feel for the community. Online resources and local social media groups can provide insights into what it’s like to live in a particular area.

4. Make a Must-Have List

Creating a list of must-haves and deal-breakers can streamline your home search. Identify essential features such as the number of bedrooms, bathrooms, outdoor space, and special amenities (like a garage or home office).

While it’s natural to want everything, keep in mind that you may need to prioritize certain features over others. This list will help you focus on properties that meet your core requirements.

5. Work with a Real Estate Agent

A knowledgeable real estate agent can be an invaluable resource throughout your homebuying journey. They can provide insights into the local market, help you find properties that meet your criteria, and negotiate on your behalf.

When choosing an agent, look for someone with experience, especially in the neighborhoods you’re interested in. Ask for recommendations from friends or family, and conduct interviews to find an agent who understands your needs and communicates well.

6. Be Prepared to Compromise

Finding the perfect home may be unrealistic, so be prepared to make compromises. You might have to adjust your expectations based on your budget or the current market.

For instance, if you can’t find a home with all the features you desire, consider looking for properties that have potential for upgrades. A home that needs some minor renovations might offer a better value than one that meets all your criteria but is out of your budget.

7. Attend Open Houses

Open houses are an excellent way to explore various properties and get a sense of what’s available in your price range. Take notes and pictures while attending open houses to help you remember each property.

During your visits, pay attention to details like the layout, storage space, and overall condition of the home. Don’t hesitate to ask the listing agent questions about the property, neighborhood, and any recent renovations.

8. Get a Home Inspection

A home inspection is a critical step that should never be overlooked. A qualified inspector will assess the property for structural issues, plumbing and electrical systems, pests, and other potential problems.

Investing in a home inspection can save you from costly surprises later. If the inspection reveals significant issues, you may want to negotiate repairs with the seller or reconsider your offer.

9. Understand the Offer Process

Once you find a home you love, work with your agent to craft a competitive offer. Understand the terms of your offer, including contingencies (like financing or inspection) and deadlines for responses.

In a competitive market, it may be necessary to act quickly and present a strong offer. Your agent can guide you in determining an appropriate offer price based on comparable sales in the area.

10. Plan for Closing Costs

Closing costs typically range from 2% to 5% of the home’s purchase price and can include loan fees, title insurance, appraisal fees, and more. It’s essential to budget for these expenses, as they can add up quickly.

Ask your lender for a Good Faith Estimate (GFE) that outlines your expected closing costs. Being prepared for these expenses will help you avoid surprises and ensure a smoother closing process.

Conclusion

Buying your first home can be both thrilling and daunting, but being well-prepared can make the journey much more manageable. By following these tips, you’ll be better equipped to navigate the homebuying process with confidence. Remember to take your time, do your research, and lean on professionals when needed. Happy house hunting.

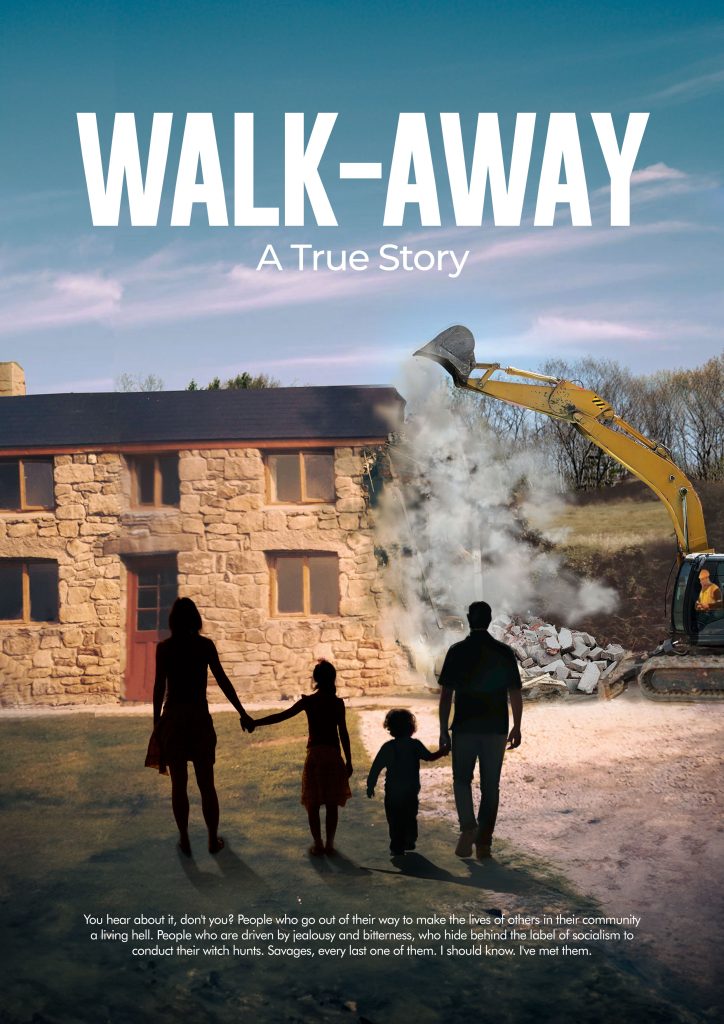

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.