Real estate investment can be a lucrative venture, but it’s not without its risks. A thorough risk assessment is essential for investors to make informed decisions about when to hold onto a property and when to walk away. This article delves into the key elements of risk assessment in real estate, providing a framework for evaluating potential investments and navigating the complexities of the market.

Understanding Risk in Real Estate

Risk in real estate refers to the potential for loss or adverse outcomes associated with property investment. This can include financial loss, decreased property value, or difficulties in leasing or selling a property. Risks can stem from various factors, including market conditions, location, property management, and economic trends. Understanding these risks is crucial for making sound investment decisions.

Types of Risks

- Market Risk: Fluctuations in the real estate market can significantly impact property values. Understanding local market trends, supply and demand dynamics, and economic indicators is crucial. For instance, an oversupply of rental properties can lead to increased vacancy rates and reduced rental income.

- Location Risk: The adage “location, location, location” holds true in real estate. Properties in declining neighborhoods may face higher vacancy rates and reduced values. Factors such as crime rates, quality of local schools, and access to amenities greatly influence a property’s desirability.

- Financial Risk: This includes interest rate fluctuations, changes in lending policies, and overall economic conditions that affect financing availability. A rise in interest rates can increase borrowing costs, impacting cash flow and the overall profitability of an investment.

- Operational Risk: Poor property management can lead to increased costs, tenant turnover, and ultimately lower returns on investment. Issues such as delayed maintenance, ineffective tenant screening, and inadequate marketing can significantly impact a property’s performance.

- Regulatory Risk: Changes in zoning laws, property taxes, or landlord-tenant regulations can impact property profitability. Investors need to stay informed about local regulations that may affect their investments, as these can change unexpectedly and have significant financial implications.

Assessing Risks: A Comprehensive Framework

A structured approach to risk assessment can help investors identify potential pitfalls and make informed decisions. Here are the key steps to conducting a thorough risk assessment:

1. Market Analysis

Conduct a thorough analysis of the real estate market in the area of interest. Look at historical trends, current market conditions, and future projections. Key data points include:

- Property Appreciation Rates: Historical data on property values can provide insight into future performance. Look for trends in appreciation over the past few years.

- Rental Demand and Vacancy Rates: Understanding the rental market is crucial for investment properties. High demand and low vacancy rates indicate a healthy rental market.

- Comparable Property Sales: Analyze recent sales of similar properties to gauge market value and set realistic pricing expectations.

2. Location Evaluation

Assess the specific location of the property. Consider factors such as:

- Proximity to Amenities: Properties close to schools, shopping centers, and public transport tend to attract more tenants and buyers.

- Crime Rates: High crime rates can deter potential tenants and lower property values.

- Future Development Plans: Research any upcoming developments in the area that may enhance property values or, conversely, create competition.

3. Financial Review

Evaluate the financial aspects of the investment. Key considerations include:

- Purchase Price versus Market Value: Ensure the property is priced fairly based on current market conditions. Overpaying can lead to long-term financial issues.

- Expected Rental Income versus Operating Expenses: Calculate potential cash flow by projecting rental income and subtracting operating expenses, including maintenance, property management fees, and taxes.

- Financing Options and Interest Rates: Compare different financing options to find the most favorable terms. Understand how changes in interest rates could affect your investment.

- Cash Flow Projections: Create detailed cash flow projections for the next five to ten years, accounting for potential changes in income and expenses.

4. Operational Assessment

Analyze the operational aspects of the property. This includes:

- Current Property Management Practices: Evaluate the effectiveness of current property management. Inefficient practices can lead to increased costs and tenant dissatisfaction.

- Tenant Demographics and Retention Rates: Understanding the tenant profile can help tailor marketing strategies and improve tenant retention.

- Maintenance Costs and Property Condition: Assess the physical condition of the property and estimate future maintenance costs. A property requiring extensive repairs can significantly impact cash flow.

5. Regulatory Considerations

Stay informed about local regulations that may affect the property. This includes zoning laws, property taxes, and any upcoming legislation that could impact the investment. Regularly consult with real estate professionals and legal advisors to stay updated on changes.

Decision-Making: When to Hold or Walk Away

When to Hold

- Positive Cash Flow: If the property generates consistent positive cash flow, it may be worth holding onto, even amid market fluctuations. A steady income can provide financial stability and cover expenses.

- Appreciation Potential: If the area shows signs of future growth and development, holding onto the property could yield significant returns. Look for indicators such as infrastructure improvements and new businesses entering the area.

- Stable Tenancy: A property with long-term tenants and low vacancy rates is often a good candidate to keep. Strong tenant relationships can lead to fewer turnovers and lower costs.

- Favorable Market Conditions: If the market is currently unfavorable but shows signs of recovery, it may be wise to hold until conditions improve.

When to Walk Away

- Negative Cash Flow: If expenses consistently exceed income, it may be time to exit the investment. A negative cash flow situation can quickly deplete resources and indicate deeper issues.

- Declining Market: If property values are in a downward trend with no signs of recovery, selling may be the best option. Holding onto a depreciating asset can lead to significant losses.

- High Maintenance Costs: Properties that require excessive repairs and upkeep can quickly drain resources, making them less viable in the long run. If the cost of repairs outweighs potential returns, consider selling.

- Regulatory Changes: If new regulations impose restrictions that significantly impact profitability, walking away might be the most prudent choice. Changes in zoning laws or rental regulations can alter the investment landscape.

Conclusion

Risk assessment in real estate is a critical skill for investors. By understanding the various types of risks and conducting thorough evaluations, investors can make informed decisions about when to hold and when to walk away. Ultimately, the key to successful real estate investment lies in balancing risk with potential reward, ensuring that each decision is backed by comprehensive data and analysis. With a well-defined risk assessment strategy, investors can navigate the complexities of the real estate market with confidence, securing their financial future while minimizing exposure to potential losses.

It’s essential to weigh your options carefully and understand when to stand firm and when to reconsider your path. If the circumstances don’t align with your goals, sometimes the wisest choice is to take a step back and WALK AWAY.

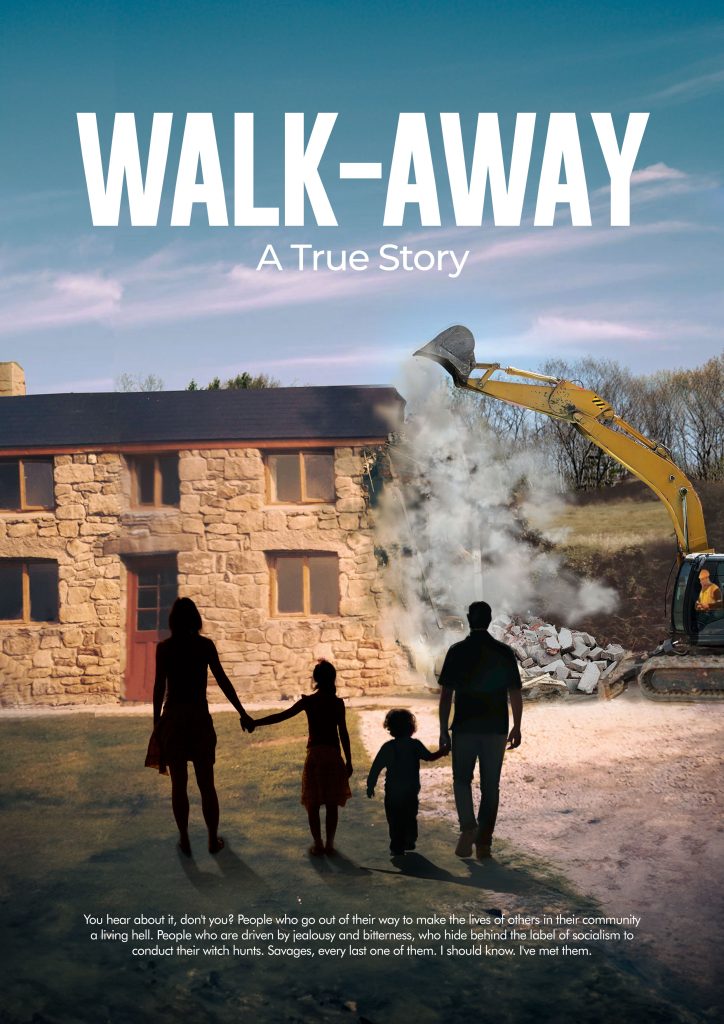

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.