Investing in real estate can be a lucrative venture, but it comes with its fair share of risks. One of the most crucial steps in the investment process is due diligence. This means conducting thorough research and analysis before making any decisions. In this article, we will explore the importance of due diligence, the pitfalls of taking shortcuts, and how to recognize when it’s time to walk away from a potential investment.

What is Due Diligence?

Due diligence is the comprehensive process of investigating a property to ensure that you are making an informed investment decision. This includes examining the property’s physical condition, financial performance, legal status, and market conditions. Proper due diligence can help you identify potential issues that could affect your investment’s profitability.

Key Components of Due Diligence

- Physical Inspection

Before purchasing a property, a thorough inspection is essential. This can include hiring a professional inspector to check for structural integrity, plumbing issues, electrical systems, and other critical aspects. A detailed inspection report can reveal hidden problems that may not be immediately visible, saving you from costly repairs down the line. - Financial Analysis

Understanding the financial aspects of a property is vital. This involves reviewing current and projected cash flow, analyzing operating expenses, and calculating return on investment (ROI). Investors should also consider property taxes, insurance, and maintenance costs. A solid financial analysis will provide clarity on whether a property aligns with your investment strategy. - Legal Considerations

Investigating the legal status of the property is crucial. This includes checking for clear titles, zoning regulations, and any existing liens or encumbrances. Understanding local laws and regulations can prevent legal complications that could arise post-purchase. - Market Research

A comprehensive market analysis will help you understand the local real estate landscape. Investigating comparable properties, examining neighborhood trends, and looking into future developments can provide insight into the potential for property appreciation. Knowing the market conditions will enable you to make informed decisions about pricing and investment strategy. - Tenant Analysis (for Rental Properties)

If you are purchasing a rental property, it’s essential to assess the current tenants, if any. Understanding their payment history, lease terms, and overall behavior can give you an idea of the property’s income stability. Additionally, researching the demand for rentals in the area can help you project future occupancy rates.

Why Due Diligence Matters

1. Risk Mitigation

Conducting thorough research minimizes the risk of unexpected problems after you purchase a property. From hidden structural issues to zoning restrictions, understanding the property’s condition and legal standing can save you significant time and money. A small oversight can lead to major financial setbacks, making due diligence a critical step.

2. Financial Insights

Due diligence allows you to assess whether a property is a sound financial investment. Analyzing cash flow, potential rental income, and expenses will give you a clearer picture of the property’s profitability. This comprehensive financial insight can help you avoid investments that may seem attractive on the surface but are fundamentally flawed.

3. Informed Negotiations

Armed with solid research, you’ll be in a better position to negotiate the price and terms of the deal. Knowledge is power in real estate transactions. When you can present data that supports your position, you are more likely to secure favorable terms, whether that means a lower purchase price or better financing options.

4. Long-term Success

Investing in real estate is often a long-term commitment. By conducting due diligence, you are laying the groundwork for future success. A well-researched investment can yield returns for years to come, while a hasty decision can lead to a burden that lasts just as long.

The Risks of Taking Shortcuts

While the allure of a quick deal can be tempting, shortcuts in property research can lead to disastrous outcomes. Here are some common pitfalls:

1. Skipping Inspections

Many investors overlook property inspections to save time and money. This can result in overlooking critical issues, such as mold, plumbing problems, or electrical hazards. The cost of repairs can quickly escalate, turning what seemed like a good investment into a financial nightmare.

2. Ignoring Financial Analysis

Failing to perform a detailed financial analysis can lead to underestimating costs or overestimating potential income, resulting in financial strain. Investors who do not fully understand their cash flow may find themselves in a position where they can no longer afford the property.

3. Neglecting Legal Considerations

Not investigating zoning laws, property titles, and local regulations can lead to legal complications that might jeopardize your investment. These issues can be time-consuming and costly to resolve, and in some cases, you may find yourself unable to use the property as intended.

4. Relying on Hearsay

Many new investors fall prey to advice from friends or family without performing their own research. Relying solely on anecdotal evidence can lead to poor investment decisions. Always verify information through reliable sources and conduct your own due diligence.

When to Walk Away

There are times when the best decision is to walk away from a deal, even if it seems promising at first. Here are some red flags to watch for:

1. Significant Repair Costs

If a property requires extensive repairs that exceed your budget or recovery timeline, it might be best to walk away. A property that needs more work than you anticipated can quickly turn into a financial burden.

2. Unclear Financials

If the financial performance of the property is ambiguous or doesn’t align with your investment goals, consider moving on. A lack of clarity around income and expenses can indicate deeper issues.

3. Legal Issues

If you uncover legal complications that could take time and resources to resolve, it might not be worth the risk. Legal battles can drain your finances and energy, detracting from your investment goals.

4. Market Instability

If the local market shows signs of decline or instability, it may be wise to reconsider your investment. A downward trend can significantly affect property values and rental demand.

5. Poor Location

Sometimes, a property might look great on paper, but its location could be a deal-breaker. High crime rates, poor school districts, or lack of amenities can deter potential tenants or buyers, making it wise to walk away.

Conclusion

Due diligence is a critical component of successful real estate investing. By avoiding shortcuts and thoroughly researching potential properties, you can mitigate risks and make informed decisions. Remember, walking away from a deal that doesn’t meet your criteria is a sign of prudence, not failure.

Investing in real estate should be approached with careful consideration and respect for the complexities involved. By prioritizing due diligence, you’re setting yourself up for long-term success in the real estate market. Always remember: the right investment is one that aligns with your goals, risk tolerance, and understanding of the market. Whether you’re a seasoned investor or just starting, a commitment to due diligence will serve you well throughout your real estate journey.

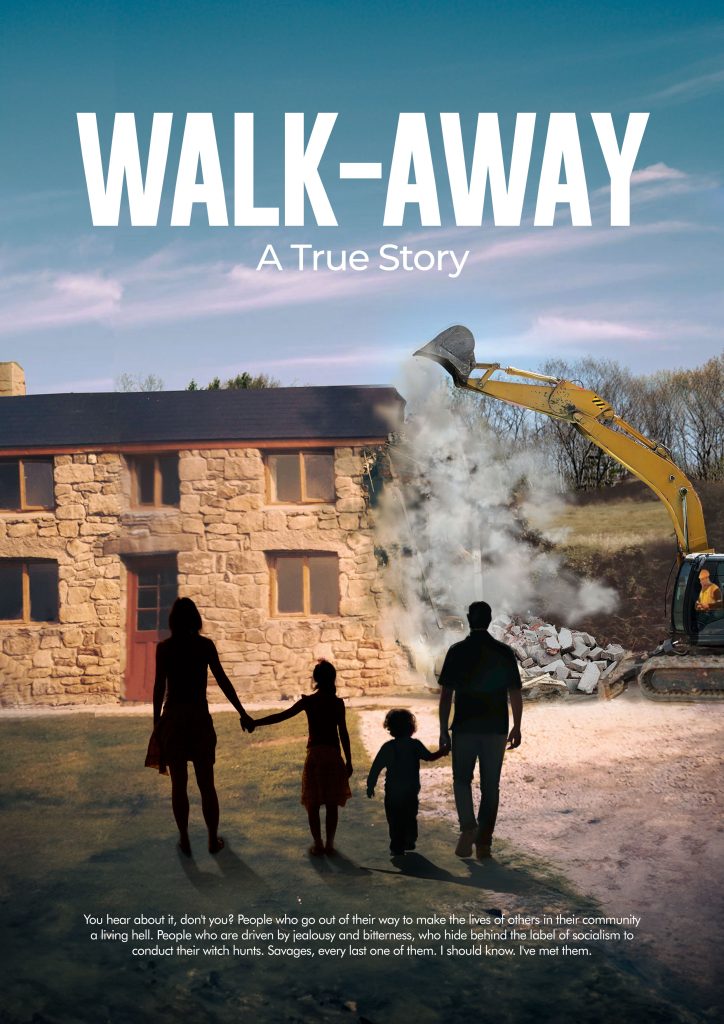

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.