When it comes to real estate investing, the age-old adage “location, location, location” holds true. The location of a property is often the single most critical factor in determining its value and potential for profit. In this article, we will explore why location is so important in real estate and how it can significantly impact your investment decisions.

1. Economic Factors

Local Economy

The economic health of a location directly affects property values. Areas with strong job growth, low unemployment rates, and a diverse economy tend to attract more residents, driving demand for housing. For instance, cities with booming technology sectors or growing healthcare industries often see an influx of workers seeking housing, which can lead to increased property values.

Supply and Demand

Real estate markets are fundamentally driven by supply and demand. A desirable location with limited housing supply will typically see higher property values. Investors should look for areas with increasing demand but constrained supply, as these conditions often lead to appreciation in property values. Tools such as real estate market reports and local MLS (Multiple Listing Service) data can provide insights into supply and demand trends.

Economic Indicators

Beyond job growth and unemployment rates, other economic indicators such as income levels, population growth, and consumer spending also play a role in assessing location viability. Investors should analyze these factors to gauge the potential for future growth and stability in property values.

2. Accessibility and Transportation

Proximity to Amenities

Properties that are near essential services such as grocery stores, schools, hospitals, and recreational facilities typically have higher values. The convenience of living close to these amenities is a significant draw for potential buyers and renters. For example, properties within walking distance of popular parks or cultural institutions can command a premium price.

Transportation Networks

Access to major highways, public transportation, and airports can greatly enhance a location’s desirability. Areas with good transportation links allow for easier commuting and increased mobility, making them more attractive to a broader range of potential tenants or buyers. The rise of remote work has also shifted some demand toward suburban areas with good transport connections, as people seek larger living spaces while maintaining access to urban job markets.

Future Infrastructure Projects

Investors should keep an eye on planned infrastructure projects, such as new transit lines or road improvements, as these can significantly enhance a location’s appeal. Areas that are set to benefit from upcoming public transportation upgrades often see a surge in property values as development projects are completed.

3. Neighborhood Characteristics

Safety and Security

Crime rates are a crucial consideration for many homebuyers and renters. Locations with low crime rates tend to be more desirable and command higher prices. Investors should research crime statistics and community safety initiatives when evaluating neighborhoods. Additionally, neighborhoods with active neighborhood watch programs or community engagement can signal a commitment to safety, further enhancing desirability.

Community and Lifestyle

The character of a neighborhood can significantly influence property values. Areas known for their vibrant culture, strong community ties, and well-maintained public spaces can attract more residents. Investors should consider the lifestyle offered by a neighborhood, including recreational activities, dining options, and community events. Neighborhoods with a strong sense of identity often foster long-term loyalty among residents, enhancing property value stability.

Schools and Education

Quality schools are a major consideration for families when choosing a neighborhood. Areas served by highly-rated public or private schools often see higher property values and lower turnover rates. Investors should research school district performance, educational programs, and community involvement in schools, as these factors can significantly affect demand for housing in the area.

4. Future Development and Growth Potential

Urban Development Plans

Cities often have plans for future development that can enhance property values. Investors should keep an eye on city planning documents, as new infrastructure, commercial projects, or residential developments can indicate growing areas. Understanding these plans can help investors identify properties that are likely to appreciate in value.

Gentrification

While gentrification can lead to increased property values, it can also displace long-time residents and alter the character of a neighborhood. Investors should approach gentrifying areas with caution, balancing the potential for profit with ethical considerations and community impact. Engaging with local community organizations can provide insights into gentrification trends and help investors navigate these complex dynamics responsibly.

Zoning Laws and Regulations

Understanding local zoning laws is crucial for any real estate investor. Zoning regulations can dictate what types of developments are permissible in an area, influencing the potential for future growth. Investors should familiarize themselves with zoning laws and any proposed changes that could affect property values and development opportunities.

5. Market Trends and Cycles

Economic Cycles

Real estate markets are cyclical, influenced by broader economic trends. Understanding the current phase of the market cycle—whether it’s a buyer’s market, seller’s market, or a balanced market—can help investors make informed decisions about when and where to invest. Recognizing signs of market shifts, such as changes in interest rates or consumer confidence, can provide a competitive edge.

Comparative Market Analysis

Conducting a comparative market analysis (CMA) is essential for understanding property values in a given location. By analyzing recent sales data, rental rates, and other market indicators, investors can gauge the potential profitability of a property based on its location. Tools like online real estate platforms can assist in gathering this data for informed decision-making.

Long-Term Trends

Investors should also consider long-term trends that may affect property values, such as demographic shifts, environmental changes, and technological advancements. For example, the increasing popularity of sustainable living and eco-friendly developments may impact future property demand and pricing.

Conclusion

In real estate investing, location is paramount. It influences property values, rental demand, and overall profitability. Successful investors take the time to research and analyze various factors related to location, ensuring that they make informed decisions that align with their investment goals. By understanding the importance of location, investors can better position themselves for success in the competitive real estate market.

As the landscape of real estate continues to evolve, staying informed about location dynamics will be key to identifying lucrative opportunities and maximizing the potential for profitable investments. Whether you are a seasoned investor or just starting, prioritizing location in your investment strategy will pave the way for enduring success in real estate.

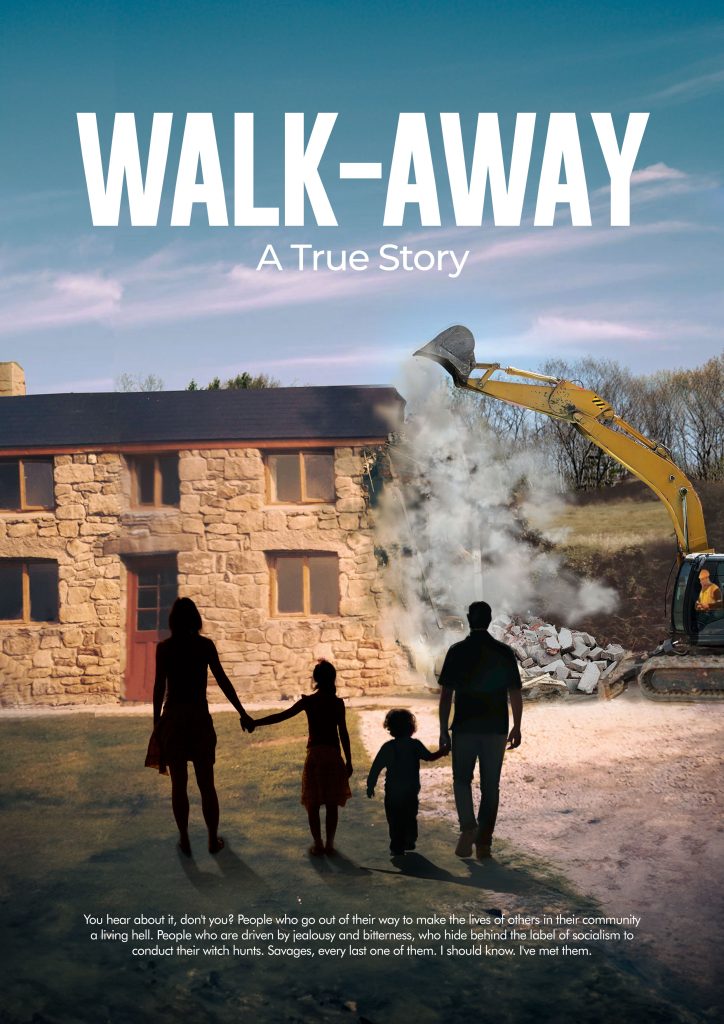

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.