Real estate investing can be one of the most reliable ways to build long-term wealth—but only if you know how to separate a great opportunity from a costly mistake. While every deal may look promising on the surface, successful investors rely on fundamentals, data, and discipline rather than hype or emotion.

This guide breaks down the essential factors that help you identify a good real estate deal and avoid a bad one.

What Defines a Good Real Estate Deal?

A good deal isn’t just about buying cheap—it’s about buying right. Here are the core indicators seasoned investors look for:

1. Strong Location Fundamentals

Location remains the cornerstone of real estate value. A good deal is usually found in an area with:

- Job growth and economic stability

- Access to transport, schools, and amenities

- Low crime rates

- High rental demand or buyer interest

Even a modest property in a strong location often outperforms a perfect property in a declining area.

2. Positive Cash Flow (or Clear Path to It)

A solid investment should either:

- Generate immediate positive cash flow, or

- Have a realistic plan to become cash-flow positive through renovations, rent increases, or market appreciation

If expenses consistently outweigh income with no clear improvement strategy, that’s a warning sign.

3. Realistic Purchase Price

Good deals are aligned with true market value, not emotional pricing. Investors compare:

- Recent comparable sales (comps)

- Price per square meter/foot

- Rental yield relative to price

If a deal only “works” under overly optimistic assumptions, it’s likely not a good deal.

4. Manageable Risk

Every investment has risk, but good deals have controlled risk:

- Conservative financing terms

- Reasonable renovation costs

- Exit strategies (sell, rent, refinance)

The more exit options a property offers, the stronger the deal.

Red Flags That Signal a Bad Deal

Bad deals often look attractive at first glance but fall apart under scrutiny. Watch out for these common warning signs:

1. Numbers That Don’t Add Up

If the deal relies on:

- Unrealistically high rental income

- Ignoring maintenance, vacancy, or management costs

- “Future appreciation” as the main justification

…it’s time to walk away.

2. Poor or Declining Location

Even a cheap property can become expensive if it’s in:

- A shrinking or unstable market

- An area with rising crime or declining infrastructure

- A location with limited tenant or buyer demand

Low prices often reflect deeper problems.

3. Major Hidden Repairs

Structural issues, outdated electrical systems, plumbing problems, or foundation damage can quickly turn a deal into a financial sinkhole. If inspections reveal:

- Costs beyond your budget or experience

- Issues that affect safety or habitability

It’s often smarter to step back.

4. Emotional or Pressured Decisions

Bad deals thrive on urgency:

- “This won’t last—decide today”

- “Everyone else is buying here”

- “Trust me, it’ll work out”

Successful investors rely on analysis, not pressure or fear of missing out.

The Role of Due Diligence

The difference between good and bad deals is often due diligence. Smart investors always:

- Analyze numbers conservatively

- Inspect thoroughly

- Research the market deeply

- Plan multiple exit strategies

Walking away from a deal is not a failure—it’s a sign of discipline.

In real estate investing, profit is made when you buy—not when you sell. Learning how to objectively evaluate opportunities protects your capital, reduces risk, and sets you up for long-term success.

A good deal makes sense on paper, aligns with market reality, and fits your strategy. A bad deal depends on hope, hype, or shortcuts.

When in doubt, remember: there will always be another deal—but lost capital is much harder to recover.

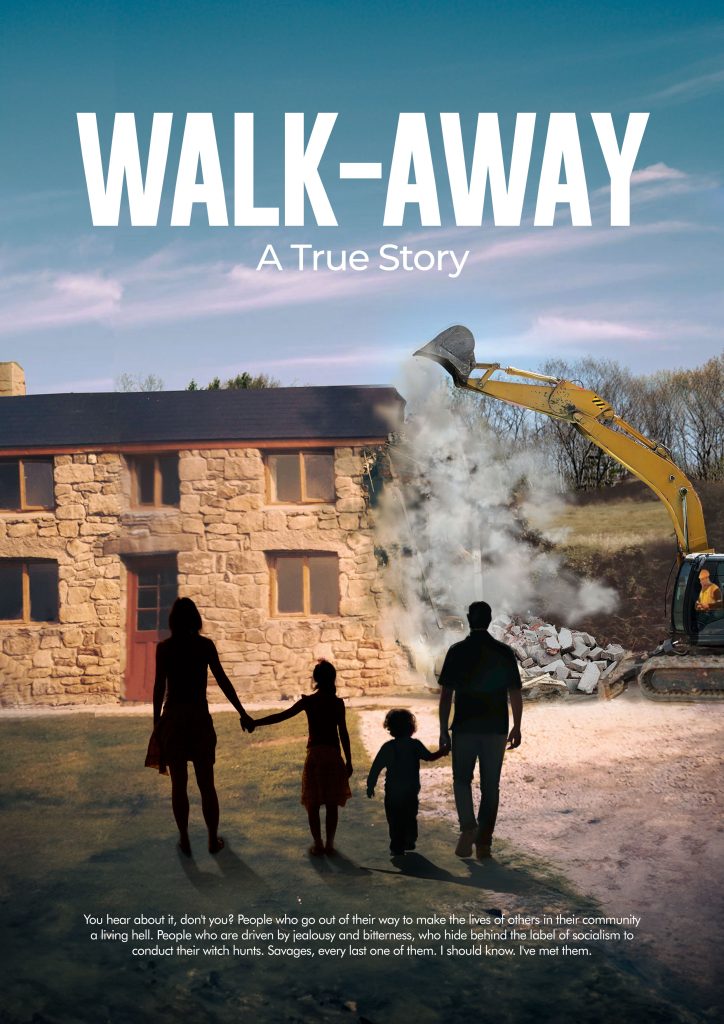

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.