Property investment is often seen as a reliable path to long-term wealth, passive income, and financial security. While it can be highly rewarding, first-time property investors frequently make avoidable mistakes that can turn a promising investment into a costly lesson.

Understanding these common pitfalls—and knowing how to avoid them—can help you make smarter decisions, protect your capital, and build a stronger foundation for your property portfolio.

1. Failing to Do Proper Market Research

The mistake:

Many new investors buy property based on emotion, hype, or advice from friends without fully understanding the local market. This often leads to overpaying or investing in areas with low rental demand.

How to avoid it:

Research the area thoroughly. Look at rental demand, vacancy rates, population growth, employment opportunities, and future infrastructure plans. Compare similar properties to understand realistic prices and rental returns. Data-driven decisions always outperform emotional ones.

2. Underestimating the True Costs of Ownership

The mistake:

First-time investors often focus only on the purchase price and mortgage, overlooking ongoing expenses such as maintenance, property management, insurance, taxes, and unexpected repairs.

How to avoid it:

Create a detailed budget before buying. Factor in all recurring and potential costs, and maintain an emergency fund for surprises. A property that looks profitable on paper can quickly become a burden if costs are underestimated.

3. Overleveraging and Poor Financing Decisions

The mistake:

Borrowing the maximum amount possible without considering interest rate changes or cash flow risks can put investors under financial pressure, especially during market downturns.

How to avoid it:

Choose a financing structure that allows breathing room. Stress-test your investment by asking: Can I still afford this property if interest rates rise or if it remains vacant for a few months? Conservative leverage often leads to long-term stability.

4. Ignoring Cash Flow and Focusing Only on Appreciation

The mistake:

Some investors rely solely on future property value increases while ignoring current cash flow. This can be risky if market growth slows or stagnates.

How to avoid it:

Prioritize properties with positive or at least neutral cash flow. Rental income should ideally cover expenses, ensuring the property supports itself while you benefit from long-term appreciation.

5. Skipping Professional Advice

The mistake:

Trying to do everything alone to save money—without consulting real estate agents, lawyers, accountants, or property managers—can lead to costly legal, tax, or operational mistakes.

How to avoid it:

Surround yourself with experienced professionals. The right advice can help you structure deals efficiently, avoid legal issues, and optimize tax benefits. Their fees are often small compared to the losses they help you prevent.

6. Choosing the Wrong Property Type

The mistake:

Buying a property that doesn’t align with market demand—such as a luxury home in a low-income area or an oversized property with limited renters—can lead to long vacancy periods.

How to avoid it:

Match the property to the target tenant. Understand who rents in the area and what they’re looking for. Practical, well-located properties often perform better than flashy or overly unique ones.

7. Letting Emotions Drive Decisions

The mistake:

Falling in love with a property and overlooking red flags like poor location, structural issues, or weak rental returns.

How to avoid it:

Treat property investment as a business, not a personal purchase. Focus on numbers, risk, and long-term performance rather than personal taste.

Final Thoughts

Mistakes are part of the learning process, but in property investment, they can be expensive. By doing thorough research, planning finances carefully, seeking professional guidance, and staying objective, first-time investors can avoid common traps and build a solid, profitable portfolio.

Successful property investing isn’t about luck—it’s about preparation, patience, and informed decision-making.

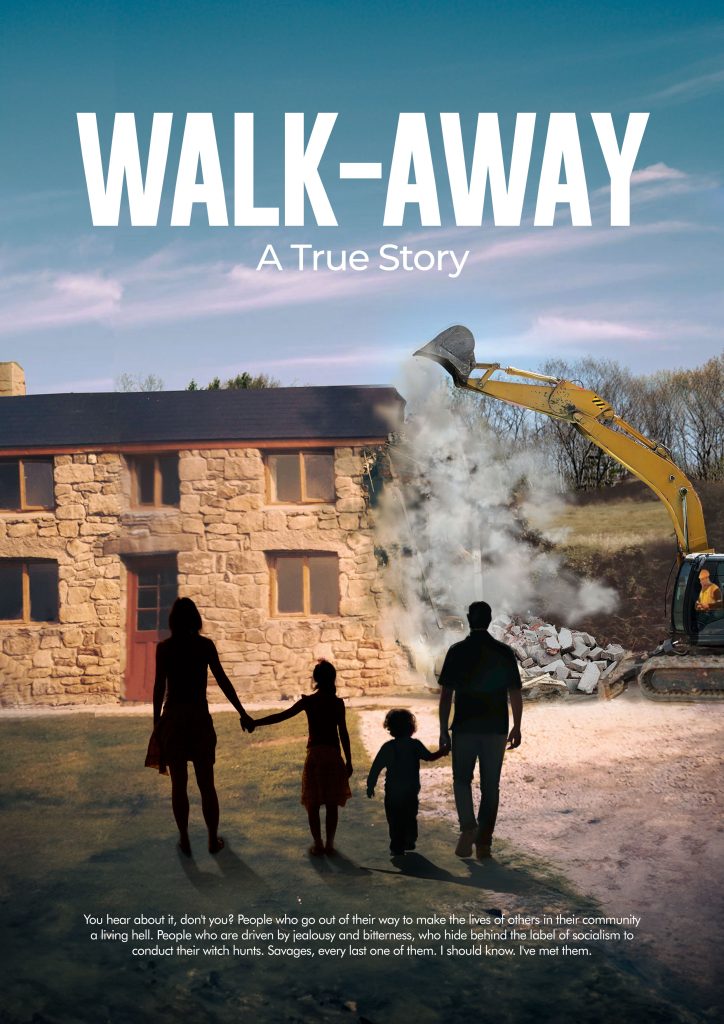

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.