Investing in real estate can be a lucrative endeavor, but it requires careful planning and strategy. Here are some of the best real estate investment strategies to consider:

1. Buy and Hold

This long-term strategy involves purchasing properties and holding them for an extended period. Investors benefit from property appreciation and rental income. Key points include:

- Market Research: Understand local market trends and property values. Use resources like neighborhood reports and historical price data to make informed decisions.

- Cash Flow Analysis: Ensure rental income covers expenses and generates profit. Consider all costs, including mortgage payments, property taxes, insurance, and maintenance.

Pros and Cons

Pros: Steady income, property appreciation, tax benefits.

Cons: Requires significant capital, property management responsibilities.

2. Fix and Flip

This strategy focuses on buying undervalued properties, renovating them, and selling them for a profit. Considerations include:

- Budgeting for Renovations: Accurately estimate renovation costs to avoid overspending. It’s crucial to prioritize renovations that add the most value.

- Timing the Market: Sell when property values are high to maximize returns. Monitor market trends and be ready to act quickly.

Pros and Cons

Pros: Potential for high returns, quick profits.

Cons: Market risk, renovation challenges.

3. Real Estate Investment Trusts (REITs)

REITs allow investors to buy shares in real estate portfolios, providing a way to invest without directly owning properties. Benefits include:

- Liquidity: Shares can be bought and sold on stock exchanges, making it easier to access your investment.

- Diversification: Invest in various property types and locations, reducing risk.

Pros and Cons

Pros: Passive income, professional management.

Cons: Market volatility, management fees.

4. Rental Properties

Owning rental properties can provide steady cash flow. Strategies to consider:

- Single-Family vs. Multi-Family: Decide whether to invest in single-family homes or multi-family units based on your investment goals. Multi-family properties often yield higher returns.

- Property Management: Consider hiring a property management company to handle day-to-day operations, tenant relations, and maintenance issues.

Pros and Cons

Pros: Consistent income, long-term value appreciation.

Cons: Ongoing maintenance, tenant management.

5. Wholesaling

Wholesaling involves finding properties at a discount, securing a contract, and selling that contract to another buyer for a fee. Key aspects include:

- Networking: Build relationships with sellers and buyers to find good deals. Attend real estate events and join local investor groups.

- Negotiation Skills: Be prepared to negotiate prices and terms effectively. Strong negotiation can significantly increase your profit margins.

Pros and Cons

Pros: Low capital requirement, quick cash flow.

Cons: Requires strong market knowledge, can be competitive.

6. Real Estate Crowdfunding

Crowdfunding platforms allow multiple investors to pool resources to invest in real estate projects. Advantages include:

- Lower Capital Requirement: Invest with smaller amounts of capital compared to traditional real estate investing, making it more accessible.

- Access to Diverse Projects: Participate in various real estate ventures, from residential to commercial properties.

Pros and Cons

Pros: Diversification, passive income.

Cons: Less control over investments, potential for platform risks.

7. Short-Term Rentals

With platforms like Airbnb, short-term rentals can be a profitable investment. Considerations include:

- Location: Properties in tourist-heavy areas tend to perform better. Research local demand and occupancy rates.

- Legal Regulations: Be aware of local laws regarding short-term rentals, including permits and zoning restrictions.

Pros and Cons

Pros: Higher rental rates, flexible use.

Cons: Seasonal income fluctuations, management challenges.

8. Lease Options

A lease option allows an investor to lease a property with the right to purchase it later. This strategy can be beneficial for both buyers and sellers:

- Less Initial Capital: Acquire properties without a large down payment, making it easier for new investors.

- Flexibility: Test the property before committing to purchase, reducing the risk of a bad investment.

Pros and Cons

Pros: Low upfront costs, potential for appreciation.

Cons: Complex agreements, potential legal issues.

9. Real Estate Development

For those with more capital and experience, real estate development can be a lucrative strategy. This involves purchasing land, constructing new buildings, or renovating existing properties for sale or lease. Key considerations include:

- Market Demand: Conduct thorough market analysis to identify profitable development opportunities.

- Financing: Secure adequate financing and budget for potential overruns.

Pros and Cons

Pros: High potential returns, significant impact on communities.

Cons: High risk, lengthy timelines.

Conclusion

Choosing the right real estate investment strategy depends on your financial goals, risk tolerance, and market conditions. Whether you prefer the stability of buy-and-hold investments or the quick returns of fix-and-flip, understanding these strategies can help you build a successful real estate portfolio. Always conduct thorough research and consider consulting with professionals to make informed decisions. Remember, the key to successful investing is knowing when to stay in the game and when to walk away.

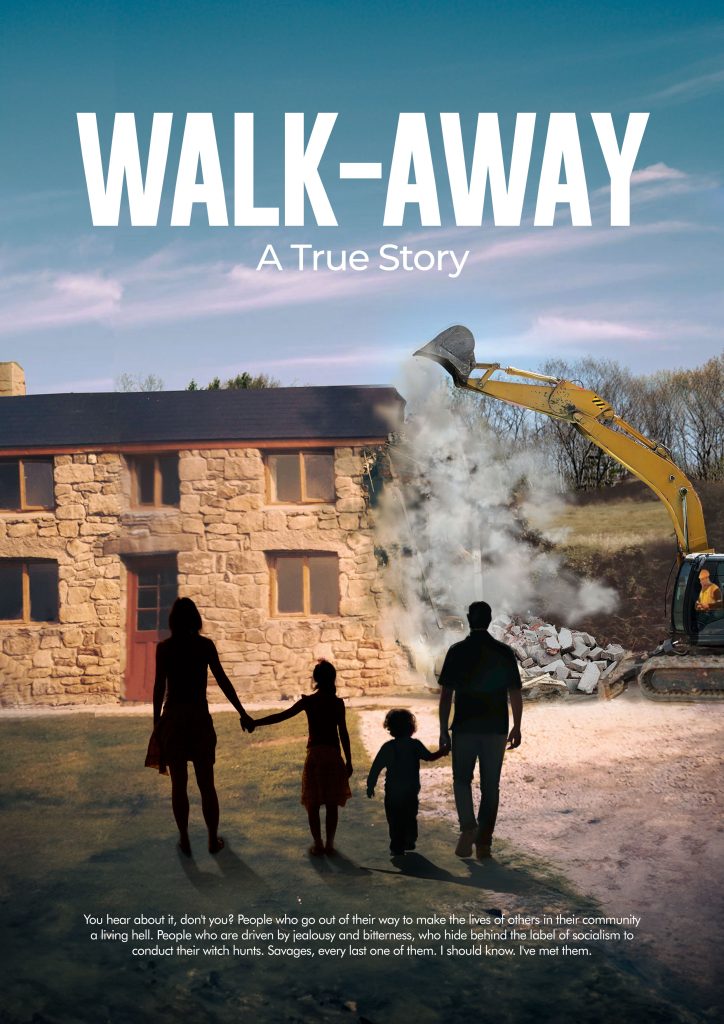

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.