Investing in real estate can be a highly rewarding venture, offering a myriad of benefits for those willing to navigate the complexities of the market. However, like any investment, it comes with its challenges. Understanding both the advantages and the pitfalls is crucial for making informed decisions. This article delves into the benefits of real estate investment and highlights common mistakes to avoid, providing a roadmap for prospective investors.

Benefits of Real Estate Investment

1. Cash Flow

One of the most appealing aspects of real estate investment is the potential for consistent cash flow. Rental properties can generate monthly income that, after deducting expenses such as mortgage payments, property taxes, and maintenance costs, can provide a stable source of revenue. This cash flow can serve various purposes, from reinvesting in additional properties to covering everyday living expenses or funding retirement.

2. Appreciation

Real estate has a historical tendency to appreciate over time, meaning the value of your property can increase. While appreciation is not guaranteed, many investors find that their properties grow in value, resulting in substantial returns when sold. Factors influencing appreciation include location, economic conditions, and property improvements. Understanding these dynamics can help investors identify properties with high appreciation potential.

3. Tax Advantages

Real estate investors benefit from a range of tax deductions, including mortgage interest, property taxes, and depreciation. Depreciation allows investors to write off a portion of the property’s value over time, further reducing taxable income. These tax benefits can significantly enhance overall profitability and contribute to long-term wealth accumulation.

4. Diversification

Real estate offers a valuable opportunity for diversification within an investment portfolio. By including real estate alongside stocks and bonds, investors can mitigate risk, as real estate often behaves differently than other asset classes. This diversification can lead to more stable returns and reduced volatility, especially during economic downturns.

5. Leverage

One of the unique advantages of real estate investment is the ability to use leverage. Investors can purchase properties with borrowed money, enabling them to control larger assets with a smaller initial investment. This leverage can amplify potential returns, allowing investors to build wealth more quickly. However, it also increases risk, making it essential to manage debt levels carefully.

6. Tangible Asset

Unlike stocks or bonds, real estate is a tangible asset that can provide a sense of security. Investors can physically see and manage their properties, which can be reassuring in times of market volatility. Additionally, real estate can be used or improved upon, offering opportunities for value addition through renovations or development.

7. Inflation Hedge

Real estate often acts as a hedge against inflation. As the cost of living rises, so too do property values and rental rates, which can help maintain purchasing power. Investors who hold real estate during inflationary periods may find their investments appreciating while generating higher rental income.

8. Retirement Planning

Real estate can be a cornerstone of retirement planning. Properties can provide a steady stream of income during retirement, along with potential appreciation. Many investors choose to sell properties or downsize, using the proceeds to fund their retirement lifestyle.

Common Pitfalls to Avoid

1. Overestimating Rental Income

New investors often make the mistake of assuming they can charge higher rents than the market supports. Conducting thorough market research is essential to set realistic rental prices that will attract tenants. Utilizing comparable rental data and understanding tenant demographics can help in setting appropriate rates.

2. Underestimating Expenses

Many investors fail to account for hidden costs associated with property ownership, such as maintenance, property management fees, and unexpected repairs. Creating a comprehensive budget that includes all potential expenses is crucial to avoid financial strain. Setting aside a reserve fund for emergencies can help manage unforeseen costs.

3. Failing to Research Locations

The location of a property is one of the most critical factors affecting its value and rental potential. Investing in a declining or less desirable neighborhood can lead to poor returns. Always research local market trends, demographics, school ratings, crime rates, and future development plans before making a purchase. A well-chosen location can significantly enhance long-term investment success.

4. Ignoring Market Trends

Real estate markets fluctuate due to economic changes, interest rates, and local demand. Ignoring these trends can lead to poor investment decisions. Staying updated on market conditions, economic indicators, and local developments can help investors make informed choices and time their investments wisely.

5. Skipping Due Diligence

Neglecting due diligence can result in costly mistakes. Always conduct thorough property inspections, review titles, and understand zoning laws before purchasing. Engaging professionals, such as real estate agents and attorneys, can help ensure that all aspects of a property are thoroughly vetted.

6. Investing Without a Plan

A lack of a clear investment strategy can lead to haphazard decisions. Define your investment goals—whether they are cash flow, appreciation, or tax benefits—and develop a structured plan to achieve them. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can provide a roadmap for success.

7. Neglecting Legal Aspects

Understanding tenant rights, lease agreements, and property regulations is crucial in real estate. Failing to comply with legal requirements can result in fines or lawsuits. Familiarizing yourself with local laws and regulations can help protect your investment and ensure a smooth rental process.

8. Overextending Financially

While leveraging real estate can enhance returns, overextending financially can lead to significant risks. Investors should be cautious about taking on too much debt and should ensure they can comfortably manage mortgage payments, property taxes, and maintenance costs. A conservative approach to leveraging can help safeguard against market downturns.

Conclusion

Real estate investment offers numerous benefits, including cash flow, appreciation, and tax advantages. However, potential investors must remain vigilant about common pitfalls, such as overestimating rental income and neglecting due diligence. By understanding both the rewards and challenges of real estate, you can make informed decisions that lead to successful investments. Whether you are a seasoned investor or a beginner, approaching real estate with caution, knowledge, and a strategic plan is key to achieving long-term success in this dynamic market.

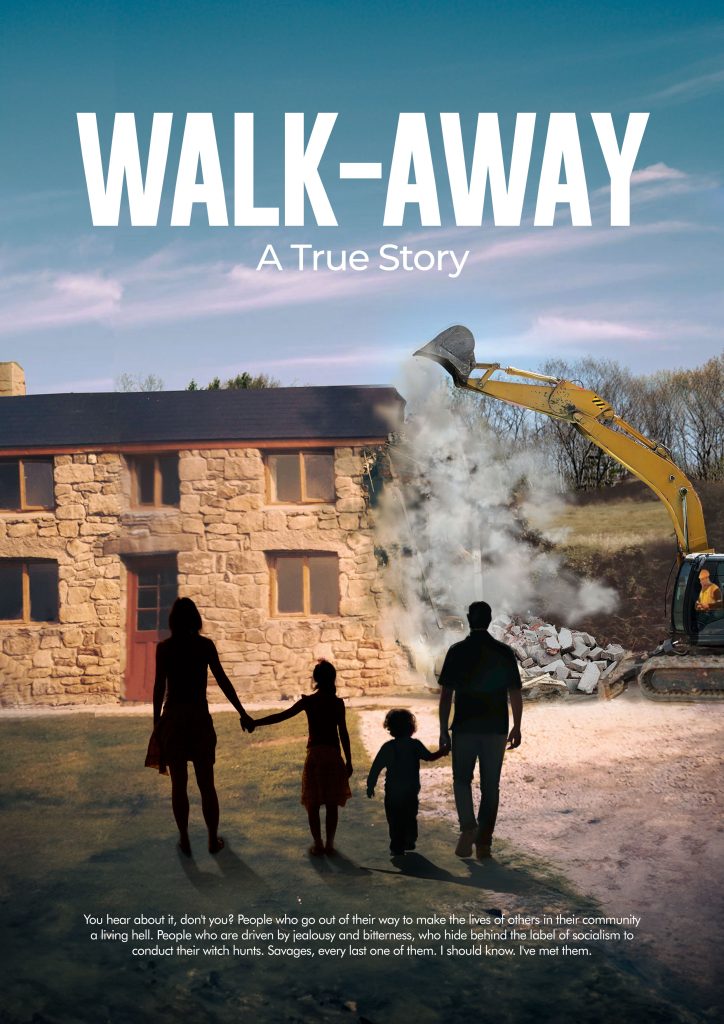

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.