The real estate landscape is evolving rapidly, driven by shifting demographics, technological advancements, and economic trends. For investors looking to capitalize on emerging markets, understanding these changes is crucial. Here, we explore the top emerging markets for real estate investment in 2025.

Key Trends Shaping the Real Estate Market

1. Sustainability and Green Building

With increasing awareness of climate change, there is a growing demand for sustainable and energy-efficient properties. Investors who focus on eco-friendly developments are likely to benefit as regulations tighten and consumer preferences shift toward greener options.

2. Remote Work and Migration Patterns

The rise of remote work has changed where people choose to live. Suburban and rural areas are seeing increased demand as professionals seek affordable housing away from crowded urban centers. This trend is particularly evident in regions with good internet connectivity and quality of life.

3. Technology Integration

The integration of technology in real estate, from virtual tours to blockchain for transactions, is transforming the industry. Investors who leverage these technologies can streamline processes and enhance property management, making their investments more efficient and attractive.

Top Emerging Markets for Real Estate in 2025

1. Southeast Asia

Countries like Vietnam, Indonesia, and the Philippines are rapidly urbanizing and experiencing significant economic growth.

- Vietnam: Cities like Ho Chi Minh and Hanoi are expanding, with infrastructure improvements attracting foreign investment. The government’s pro-business policies create a favorable environment for real estate development.

- Indonesia: Jakarta is becoming a regional hub, with strong demand for residential and commercial properties driven by a growing middle class.

2. Sub-Saharan Africa

With increasing urbanization, Sub-Saharan Africa offers unique opportunities for real estate investors.

- Nigeria: Lagos is a bustling metropolis with a housing deficit, presenting opportunities for residential developments. The demand for commercial real estate is also on the rise as businesses expand.

- Kenya: Nairobi is emerging as a tech and innovation hub, driving demand for office spaces and modern residential units.

3. Latin America

Despite economic fluctuations, several Latin American countries are showing resilience and growth potential.

- Brazil: Major cities like São Paulo and Rio de Janeiro are benefiting from infrastructure projects and a recovering economy, making them attractive for real estate investment.

- Colombia: Medellín’s transformation into a smart city is attracting international interest, particularly in residential and commercial real estate.

4. Eastern Europe

Countries in Eastern Europe are increasingly appealing to investors due to their strategic locations and economic potential.

- Poland: Warsaw is experiencing rapid growth in the tech sector, leading to increased demand for both commercial and residential properties.

- Czech Republic: Prague remains a popular destination for expatriates and tourists, sustaining a strong market for rental properties.

5. Middle East

The Middle East is diversifying its economy beyond oil, creating new real estate opportunities.

- UAE: Dubai continues to attract global investors with its luxury real estate market. Upcoming events, such as the World Expo, further boost demand.

- Saudi Arabia: The Vision 2030 initiative is transforming the country, creating opportunities in various sectors, including tourism and entertainment.

Investment Strategies for 2025

1. Focus on Emerging Neighborhoods

Investing in up-and-coming neighborhoods can yield high returns as these areas develop and attract new residents.

2. Consider Mixed-Use Developments

Mixed-use properties that combine residential, commercial, and recreational spaces are becoming increasingly popular, providing diverse income streams.

3. Embrace Technology

Utilizing technology for property management, marketing, and sales can enhance efficiency and attract tech-savvy tenants.

Conclusion

Investing in real estate in 2025 presents exciting opportunities, particularly in emerging markets across Southeast Asia, Sub-Saharan Africa, Latin America, Eastern Europe, and the Middle East. By understanding the trends shaping these markets and adapting investment strategies accordingly, investors can position themselves for success in the dynamic real estate landscape. As always, thorough research and due diligence are essential for making informed investment decisions.

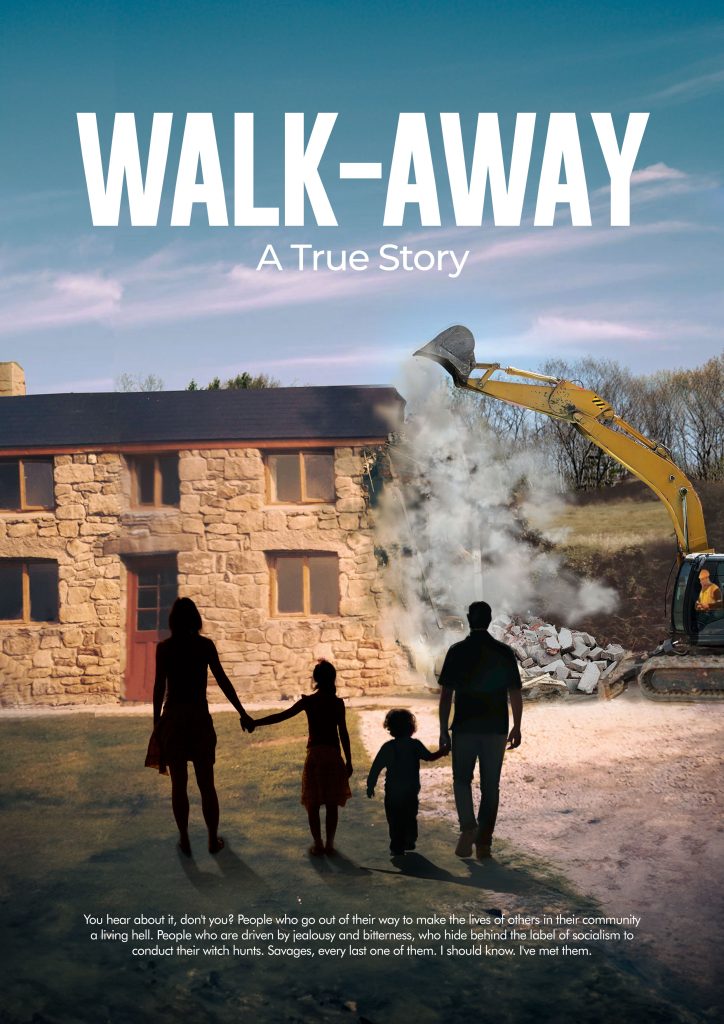

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.