Investing in real estate can be a lucrative venture, but it’s crucial to understand market trends to avoid losses, especially during downturns. Here’s a comprehensive guide on how to navigate the real estate market effectively.

Understanding Market Cycles

Real estate markets typically move through cycles, which can be broken down into four key phases:

- Recovery: This phase follows a downturn, where the market starts to stabilize. Prices begin to rise slowly, and investor confidence starts to return. It’s often characterized by increased rental demand and a gradual decline in vacancy rates.

- Expansion: During this phase, property values rise, and demand increases significantly. New construction projects are initiated, and the market experiences high levels of transactions. This is often the most profitable time for investors, as property value appreciation is rapid.

- Hyper Supply: In this phase, the market becomes saturated with new properties. While demand might still exist, it doesn’t keep pace with the oversupply, leading to stagnating prices. Investors may start to feel the pinch as rental rates begin to decline.

- Recession: The downturn phase is marked by falling prices, increased vacancies, and reduced demand. This phase can be painful for many investors, as properties may lose significant value. Understanding the signs of an impending recession is critical for any investor.

Recognizing where the market stands in this cycle is essential for timing your investments effectively.

Key Indicators of Market Health

1. Economic Indicators

Economic health directly impacts the real estate market. Key indicators include:

- Employment Rates: High employment often correlates with increased demand for housing. When people have jobs, they are more likely to buy homes or rent, driving up demand.

- GDP Growth: A growing economy usually boosts consumer confidence and spending. When GDP rises, it indicates a healthy economy, which typically supports housing demand.

- Interest Rates: Lower rates make borrowing cheaper, stimulating investment. Conversely, rising interest rates can cool down a hot market, making it crucial to monitor trends in interest rates.

2. Supply and Demand

Understanding the balance between supply and demand is vital for making informed investment decisions:

- Housing Inventory: A surplus of homes can indicate a pending downturn. Tracking the number of homes for sale and the average time they spend on the market can provide insight into future price movements.

- Housing Starts: A decrease in new construction may signal an impending slowdown. If fewer homes are being built, it can reflect declining confidence in the market.

3. Local Market Trends

Local conditions can vary significantly from national trends. Key factors to consider include:

- Neighborhood Development: Areas undergoing revitalization often present good investment opportunities. Look out for infrastructure improvements, new businesses, and community initiatives that can enhance property values.

- School Ratings and Amenities: Locations with high-rated schools and amenities tend to retain value better. Families often prioritize good schools, making these areas attractive for long-term investments.

Strategies to Avoid Investing in a Downturn

1. Conduct Thorough Research

Before investing, analyze local market conditions. Use tools like real estate reports, economic forecasts, and local news to gauge the market’s health. Platforms such as Zillow, Realtor.com, and local real estate boards can provide valuable data.

2. Diversify Your Portfolio

Investing in different types of properties (residential, commercial, rental) can mitigate risk. If one sector declines, others may remain stable. Consider investing in various geographic locations as well to spread your risk.

3. Invest in Cash Flow Properties

Properties that generate consistent cash flow can provide a buffer during downturns. Focus on rental properties in high-demand areas. Evaluate potential rental income against expenses to ensure positive cash flow.

4. Monitor Market Trends

Stay updated on economic indicators and local developments. Subscribe to real estate newsletters or follow market analysts to track trends. Joining real estate investment groups can also provide insights and networking opportunities.

5. Be Cautious with Leverage

While leveraging can amplify gains, it can also lead to significant losses during downturns. Assess your risk tolerance and consider using less debt. Maintaining a healthy debt-to-income ratio can provide more flexibility during tough times.

6. Network with Professionals

Engage with real estate agents, investors, and market analysts. They can provide insights into market conditions and help identify potential pitfalls. Building a network can also lead to partnership opportunities and access to off-market deals.

7. Consider Economic Resilience

Look for markets with economic resilience. Areas with diverse economies, such as those with a mix of industries (tech, healthcare, education), tend to fare better during downturns. Research job growth trends and demographic shifts to identify resilient markets.

Conclusion

In the world of real estate, knowledge is power. As you navigate the complexities of the market, remember that informed decisions are your best defense against downturns. By understanding market cycles, monitoring key indicators, and employing sound investment strategies, you can position yourself to succeed.

Always be prepared to WALK AWAY from a deal that doesn’t meet your criteria or shows signs of potential risk. In real estate investment, sometimes the best move is to hold back and wait for the right opportunity. The goal is to build a solid portfolio that can withstand economic fluctuations, ensuring long-term success in your real estate endeavors.

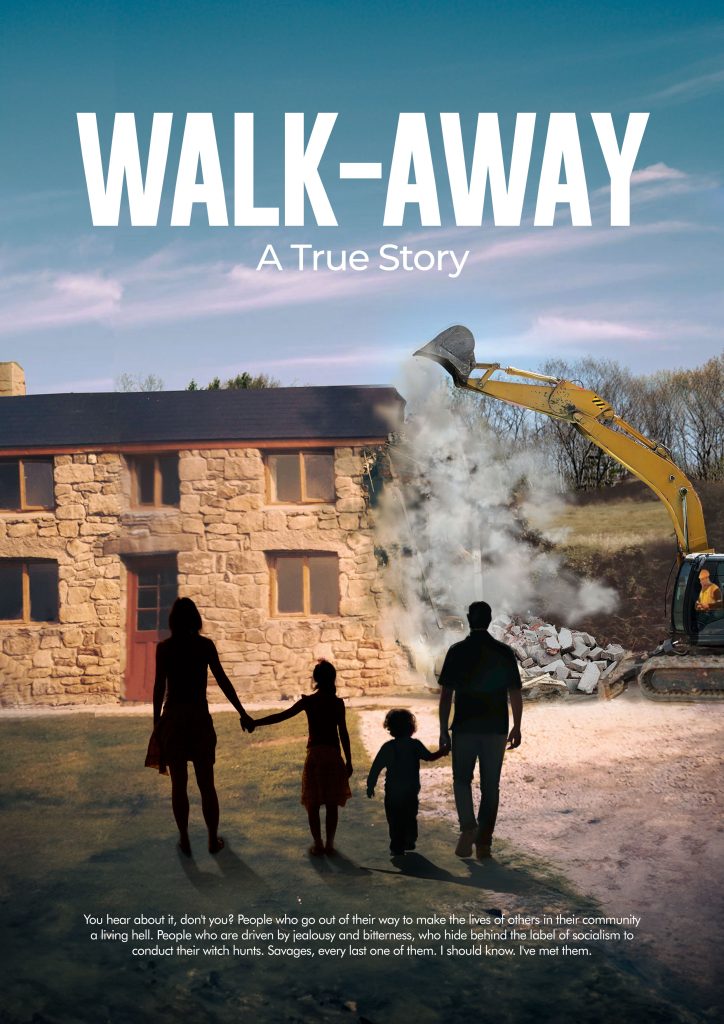

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.