Investing in real estate can be a lucrative venture, but it also comes with its fair share of challenges. Property management is a critical component of maintaining and maximizing the value of your investment. Understanding the realities of property management will help investors navigate common pitfalls and make informed decisions about when to persevere and when to walk away.

The Challenges of Property Management

1. Tenant Management

Finding reliable tenants is one of the most significant challenges. Issues such as late payments, property damage, or high turnover rates can negatively impact your investment.

- Screening Tenants: A thorough screening process is essential. This includes background checks, credit evaluations, and verifying rental history. Failing to do so can lead to problematic tenants.

2. Maintenance and Repairs

Keeping the property in good shape requires ongoing maintenance and timely repairs. Neglecting these can lead to larger, costlier issues down the line.

- Routine Maintenance: Regular inspections and upkeep help prevent major repairs. However, these can be time-consuming and costly.

3. Legal Compliance

Real estate laws vary by location, and staying compliant can be a challenge. Investors must understand landlord-tenant laws, zoning regulations, and property safety codes.

- Eviction Processes: If a tenant needs to be evicted, understanding the legal process is crucial to avoid costly mistakes.

4. Financial Management

Managing finances effectively is vital for profitability. This includes budgeting for unexpected expenses, understanding cash flow, and maintaining accurate records.

- Unexpected Costs: Property management often comes with surprise expenses, such as emergency repairs or legal fees, which can strain finances.

5. Market Fluctuations

Real estate markets can be unpredictable. Economic downturns, changes in local demand, or shifts in interest rates can affect property values and rental income.

- Risk Mitigation: Diversifying your investment portfolio and staying informed about market trends can help mitigate risks.

When to Walk Away

While property management can be rewarding, there are times when it might be wise to walk away from an investment. Here are some indicators:

1. Persistent Financial Losses

If a property consistently generates negative cash flow without a clear path to profitability, it may be time to cut your losses.

2. Incessant Maintenance Issues

If a property requires constant repairs that exceed your budget and time, it may not be a sound investment.

3. Difficult Tenants

If tenant turnover is high and you find yourself frequently dealing with problematic tenants, it might be a sign that the property is not worth the hassle.

4. Changing Market Conditions

If the real estate market in your area is declining and shows no signs of recovery, it may be prudent to sell before values drop further.

5. Personal Circumstances

Sometimes, personal circumstances can dictate the need to exit an investment. Changes in financial situation, health, or life goals should be considered.

Conclusion

Property management presents a unique set of challenges that every investor should be aware of. Understanding these challenges can help you make informed decisions, ensuring that your investments yield positive returns. It’s essential to weigh the pros and cons carefully and know when it’s time to walk away, preserving your resources for more promising opportunities. With the right knowledge and strategy, you can navigate the complexities of property management and achieve success in your real estate endeavors.

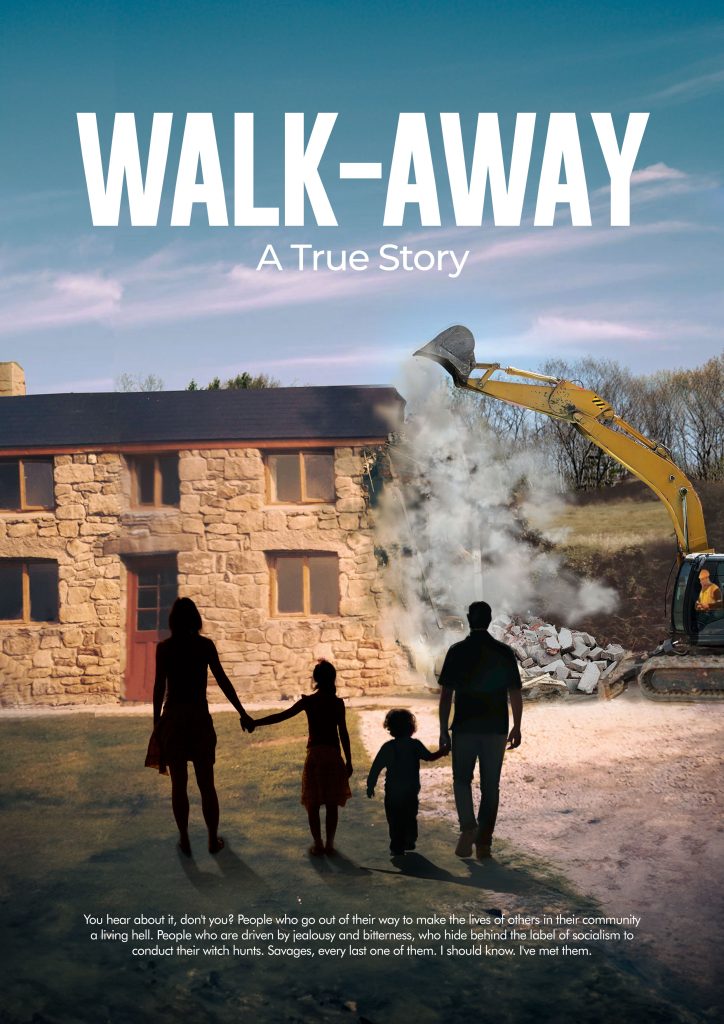

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.