Real estate investment can be a profitable venture, but it is crucial to recognize that local market variations significantly influence property values, rental rates, and investment strategies. Understanding these differences is essential for making informed decisions. This article explores the nuances of local real estate markets and provides guidance on when it may be best to walk away from an investment.

The Importance of Local Market Knowledge

Real estate is inherently local. What works in one market may not translate to another due to various factors, including economic conditions, demographics, and local regulations. Here are some key aspects to consider:

1. Economic Factors

Local economies can vary widely, impacting job growth, income levels, and overall demand for housing. For instance, a city experiencing a tech boom may see rising property values, while another with a declining manufacturing sector may struggle.

2. Demographics

Understanding the demographics of a locality—such as age, income, and family size—can help investors tailor their strategies. A market with a growing population of young professionals may favor rental properties, while a retirement community may demand single-family homes.

3. Supply and Demand Dynamics

Local supply and demand dynamics play a vital role in property valuation. An area with limited housing supply and high demand will likely see increased property values. Conversely, oversupply can lead to lower prices and longer vacancy rates.

4. Local Regulations and Zoning

Real estate regulations can differ from one municipality to another. Zoning laws, property taxes, and rental regulations can impact investment viability. Understanding these regulations is essential to avoid potential pitfalls.

Why One Size Doesn’t Fit All

Given the complexities of local markets, a one-size-fits-all approach to real estate investment is rarely effective. Here’s why:

1. Different Market Segments

Each local market may have unique segments, such as luxury, mid-range, or affordable housing. Strategies that work for one segment may not apply to another, necessitating tailored approaches.

2. Cultural Influences

Cultural factors can influence housing preferences and investment opportunities. For instance, urban areas may have a higher demand for apartments, while rural areas may favor larger homes.

3. Seasonal Variations

Some markets experience seasonal fluctuations in demand. Understanding when to buy or sell in relation to these cycles can significantly impact profitability.

When to Walk Away

Recognizing when to walk away from a potential investment is just as important as knowing when to proceed. Here are some signs that it may be time to reconsider:

1. Poor Market Conditions

If the local market shows signs of decline, such as falling prices and high vacancy rates, it may be wise to walk away. Investing in a declining market can lead to long-term losses.

2. Unfavorable Economic Indicators

Look for warning signs in local economic indicators, such as rising unemployment rates or declining population. These factors can signal a challenging investment environment.

3. Inadequate Research

If you find that you cannot obtain sufficient information about a local market or the data is inconsistent, it may indicate a lack of transparency or stability in that area. In such cases, walking away is a prudent choice.

4. Overly Complicated Regulations

When faced with complex zoning laws or burdensome regulations that could hinder investment potential, it may be best to walk away. An overly complicated legal landscape can lead to costly mistakes.

Conclusion

Understanding local market variations is essential for successful real estate investment. Each market has its unique attributes that can influence investment decisions. By recognizing these differences and knowing when to walk away, investors can make more informed choices, minimizing risks and maximizing returns. In the dynamic world of real estate, local knowledge is a powerful tool for success.

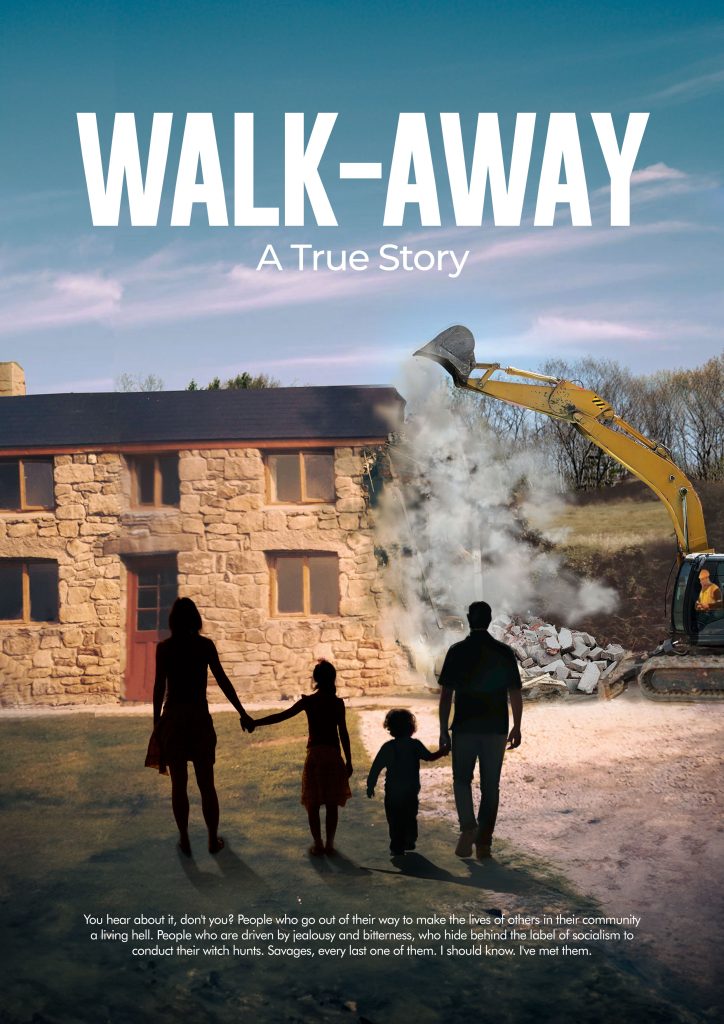

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.