Investing in real estate can be a lucrative venture, particularly when it comes to identifying undervalued properties. These properties, often overlooked by other investors, can offer excellent returns when bought at the right price and improved strategically. Here’s a guide to help you spot these hidden gems.

Understanding Property Value

Before diving into the identification process, it’s essential to understand how property value is determined. Factors include:

- Location: The neighborhood’s desirability, proximity to amenities, schools, and public transport.

- Market Trends: Local real estate trends can affect property prices significantly.

- Property Condition: The physical state of the property, including any necessary repairs or renovations.

- Comparable Sales: Analyzing recent sales of similar properties in the area.

Key Indicators of Undervalued Properties

- Below Market Value Price:

- Look for properties listed below the average market value for similar homes in the area. This could indicate a motivated seller, a distressed property, or a market anomaly.

- Long Time on Market:

- Properties that have been on the market for an extended period may be undervalued. Sellers may become more flexible with their price as time goes on, presenting an opportunity for buyers.

- Distressed Properties:

- Foreclosures, short sales, or properties in disrepair often sell for less than their potential market value. These properties require an upfront investment but can yield high returns after renovation.

- Neighborhood Development:

- Areas undergoing revitalization or infrastructure improvements (like new schools, parks, or public transport) can indicate future value increases. Identifying these neighborhoods early can lead to significant gains.

- Low Rental Yields:

- If rental properties in the area are not generating expected yields, it may signify that property prices are lower than they should be. This can also be an opportunity for savvy investors.

Conducting Thorough Research

Comparative Market Analysis (CMA)

Conduct a CMA to compare similar properties in the area. This analysis should include:

- Recent sales prices

- Current listings

- Days on market

This data provides insight into whether a property is undervalued.

Networking

Engage with local real estate agents, attend open houses, and participate in community events. Networking can provide insider information about properties before they hit the market.

Financial Analysis

Evaluate the potential return on investment (ROI). Consider:

- Purchase price

- Renovation costs

- Expected rental income

- Future resale value

Home Inspection

For properties that appear to be undervalued, get a professional home inspection. This will identify necessary repairs that could affect your investment decision.

Strategies for Success

- Be Patient:

- Finding undervalued properties takes time. Stay patient and persistent.

- Invest in Education:

- Continuous learning about real estate markets, investment strategies, and renovation techniques can enhance your ability to identify valuable opportunities.

- Leverage Technology:

- Use real estate platforms and apps to track listings, market trends, and investment opportunities. Tools like Zillow, Redfin, or local MLS systems can be invaluable.

- Build a Team:

- Surround yourself with a reliable team of professionals, including real estate agents, contractors, and financial advisors, to help navigate the process.

Conclusion

Identifying undervalued properties requires a keen eye, thorough research, and a strategic approach. By understanding the market, leveraging technology, and networking effectively, you can uncover properties that offer great potential for investment. With the right due diligence and patience, you can turn these undervalued assets into profitable real estate ventures. Happy hunting.

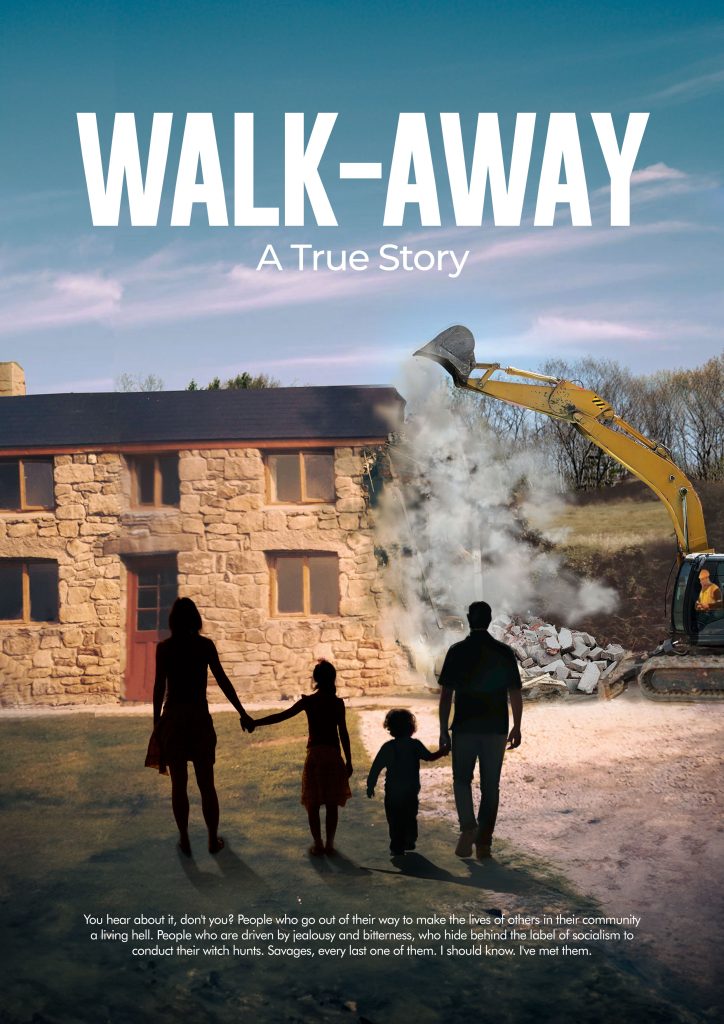

Join me, Phil Bolitho, on a gripping journey through my true life story in “Walkaway.” This book delves into the challenges I faced as a working-class Cornish lad with dreams of security and stability for my family. It reveals the harsh realities of confronting jealousy and corruption, offering lessons on resilience and the importance of standing your ground. Discover valuable insights on investment and personal growth that can help you navigate your own challenges. Don’t miss out—order your copy today at www.walkaway.uk and learn from my experiences.